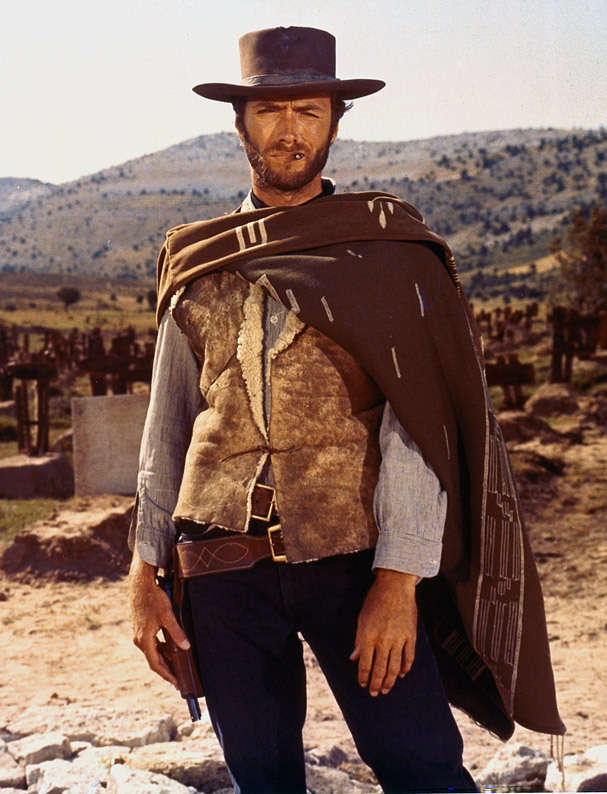

The Good, The Bad, And The Ugly Edition

The Bad

Now that PUA (Pandemic Unemployment Assistance) is effectively over nationwide, employers are still having staffing shortages with employees that never returned to work. From airlines to fast food restaurants to hospitals, workers are reluctant to return and/or are seeking careers elsewhere. However, many workers are just not returning to work at all and have decided to collect unemployment until it runs out.

Normally, individual State Departments of Labor (DOLs) would have a better handle on these situations and end benefits for those who are collecting while work is available. However, these are not quite normal times (yet). The DOLs are still overwhelmed with catching up on hearings, appeals, and a variety of other issues that were unforeseen when the pandemic took hold.

The Ugly

How does this affect your bottom line? First and most obvious, you need workers in your office, warehouse, and vehicles. Secondly, the longer employees collect, the less likely they are to return. And that causes your tax rate to rise. (See our previous post for detailed information). Your raising tax rate impacts your bottom line for years.

The Good

Most states have a very basic tenet for collecting unemployment benefits. First, the claimant must be capable of work. Secondly, the claimant must be ready, willing, and able to work.

So why is this good for your business? By taking the time to send official letters and emails to your employees and providing that same letter to the DOL, you can either coax that employee back to work or have their benefits denied from the time work was made available.

If there is suitable work available, the employee is compelled to return to their job. If the employee refuses to return, their benefits will be stopped and, in some cases, they will be forced to return the portion of money collected while work was available.

How Can We Help?

As with any dealings with a state or federal agency, the above advice is not as easy to follow as it may seem. Consultech can help you navigate through this process as we have done for clients for over 35 years. Let us help you reduce your UI Tax Rate and get employees back to work!

Consultech’ s Other Services

- Did I mention that we are also the premier Independent Contractor Model defense company in the country? We are hired by the biggest players in the United States to consult, protect, and defend their IC business models.

- Need Insurance for your Independent Contractors? Our sister company, Consultech Insurance, has the best IC insurance package in the industry by combining all three insurance programs, Occupational Accident, Contingent Liability, and Workers Compensation Insurance under the same Insurance Carrier providing a guarantee “No Audit.”

All articles by Consultech are general and brief in nature to keep the reader engaged. Our articles are not to be used as legal advice in any way.